- Report ,

- Venture Market

- December 8, 2021

Navigating the Rapidly Changing Venture Capital Market – An LP Perspective

Following a rapid recovery from the impact of the COVID-19 pandemic, venture capital has flourished since mid-2020. Many venture-backed companies proved resilient and even critical to the economy and society. In addition to elevating innovation, venture-backed companies continue to build highly valuable businesses in large markets, the continuation of a decades-long trend. These dynamics, coupled with low interest rates, and a “reverse denominator effect” (when growth in other asset classes causes exposure to venture capital to fall below its target allocation) have led to increased institutional appetite for venture capital. Limited partners, including many new to the asset class, have poured capital into venture funds, including through larger and non-traditional investment platforms. Venture capital fundraising, investment, and exit totals now regularly come in at or near record levels. Further, valuations are high, the pace of investment is heightened, and there are more funds than ever before, including an upsurge in the number of “opportunity” funds.

The recent evolution of the venture capital market has presented a challenge to limited partners who now face an increasingly complex market. Limited partners may be beginning to question the sustainability of current trends and if returns can endure. At the same time, most realize they must identify effective ways to deploy capital in an asset class they know features a strong fundamental opportunity driven by an unprecedented secular trend in technological innovation.

Venture capital has always featured a high dispersion of returns, meaning strategy, manager, and deal selection are critical to success, while mistakes can be hard to avoid and can be significantly detrimental. This dynamic is truer now than ever before. Limited partners, even those who have been successful to date, may not recognize potential flaws to their approach – this may be particularly true for those newer to the asset class. In this report, we will review some of the recent trends and share our thoughts on how limited partners can best navigate the current environment successfully to realize the full potential of the venture capital asset class going forward.

A Deeper Look at Trends

Before charting a course forward, it is helpful to review where the venture capital market stands today and examine some of the key trends – in fundraising, investments (and valuation), and exits – that reflect the major changes the market is undergoing.

Fundraising

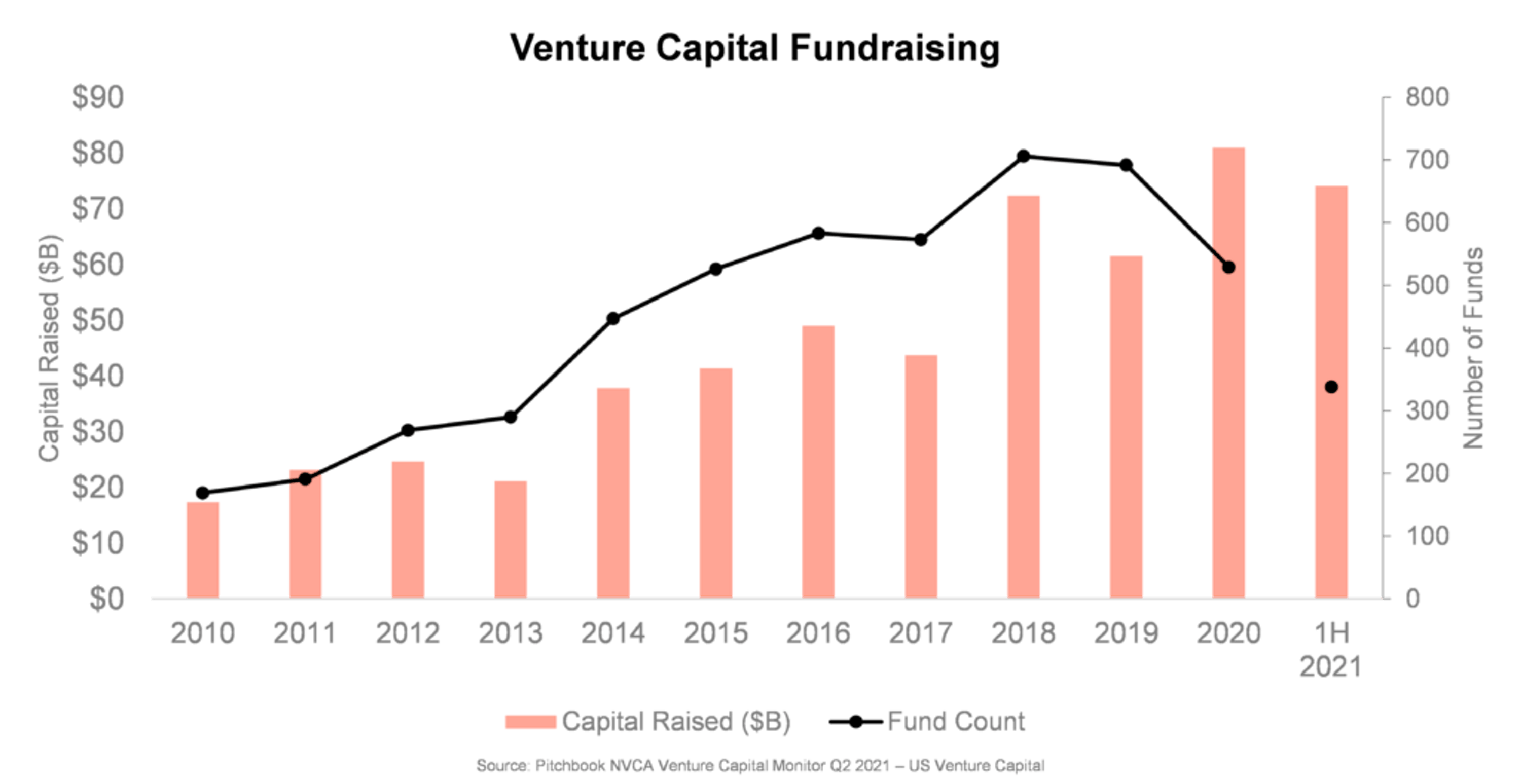

Fundraising by venture capital funds is expected to surpass $100 billion this year for the first time since 1999 and 2000, and 2021 may set an all-time record. Fundraising data serves as an indicator of limited partner interest in the asset class. The fact that fundraising totals are up is not a surprise given the broader market dynamics, and the increased appetite for high-growth technology investing.

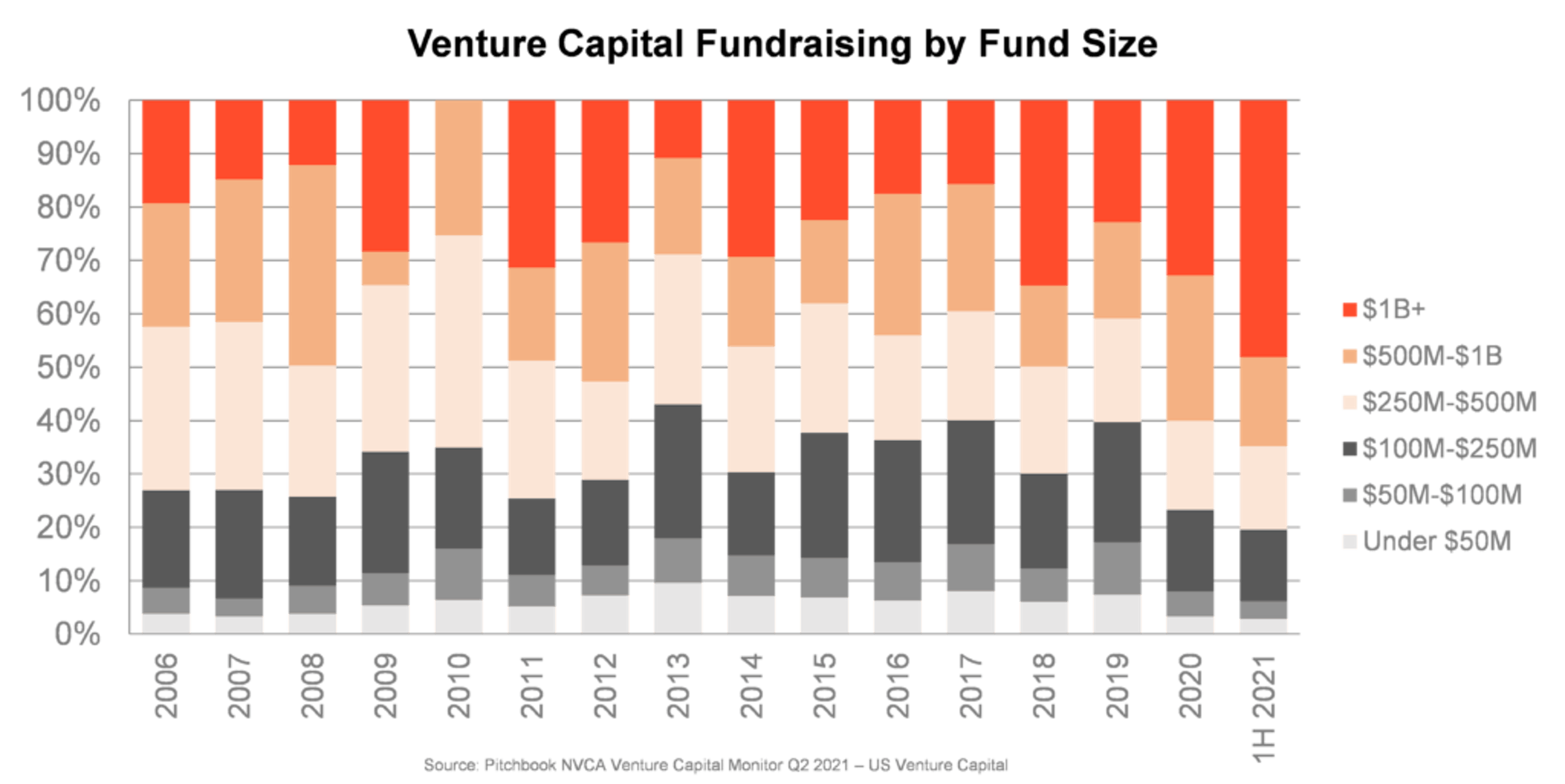

Of note, funds over $1 billion in size have accounted for almost half of all fundraising this year, which is more than any other year by far. Limited partners are piling into large funds – mega late stage funds, larger multi-stage funds, or expanding early-stage platforms. Newer limited partners in particular are more easily able to identify these larger funds and are drawn to well-known brands.

Investment and Valuations

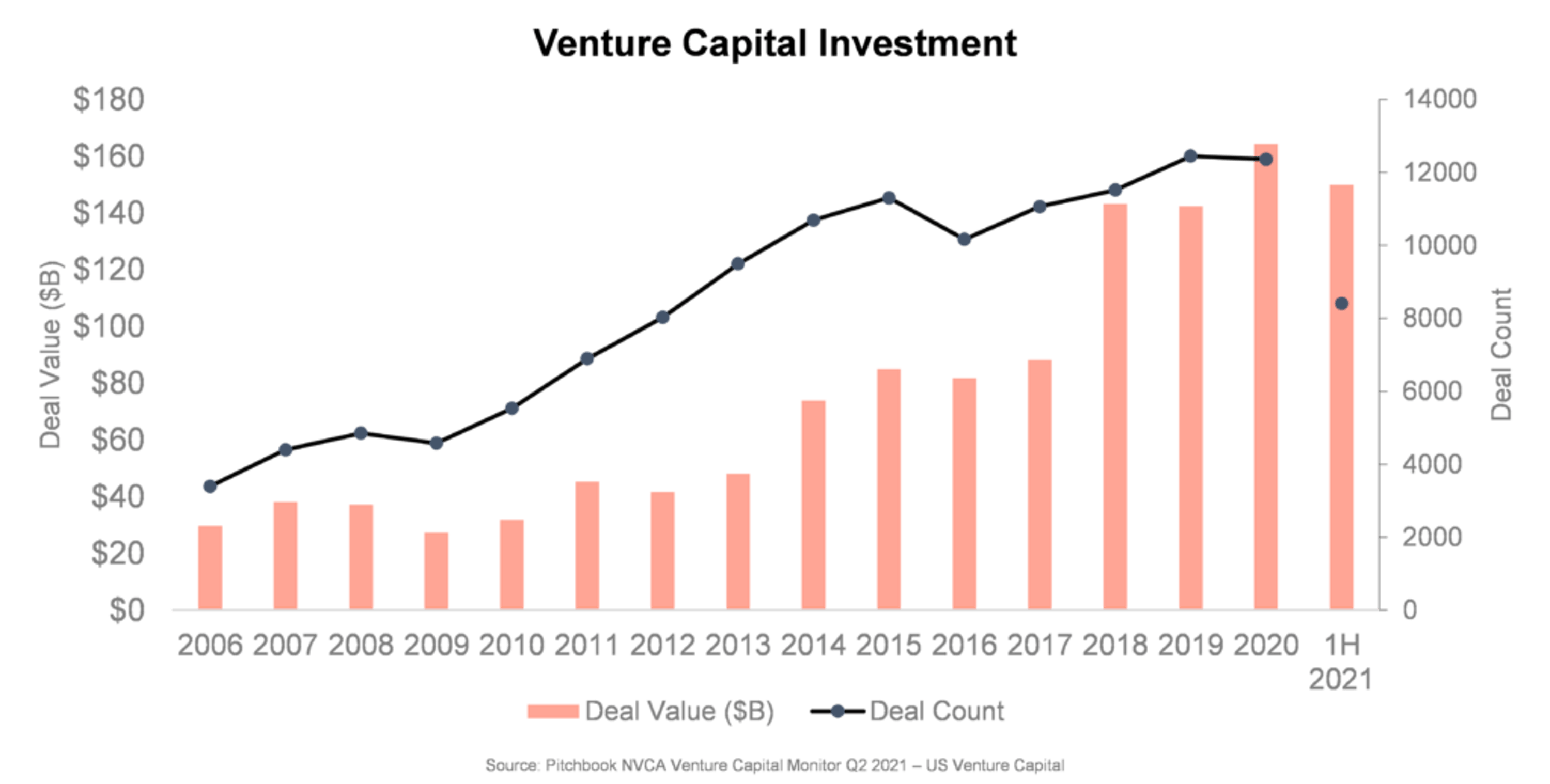

Increased limited partner commitments and larger fund sizes have translated into higher venture capital investment totals. Despite potential headwinds from the global pandemic, venture capital investments in 2020 totaled over $160 billion and 2021 is on pace to eclipse that by a significant margin.

Investment activity has been dominated by “mega deals,” those over $100 million, which represented nearly 60% of investment dollars in the first half of 2021. Investors are aggressively pursuing opportunities for high growth technology-enabled businesses and services, with the major shifts in enterprise and consumer needs and behavior as a result of the global pandemic further fueling interest in high growth technology startups. Expedited deal closings and vastly oversubscribed rounds are now common for sought-after companies, even at earlier stages.

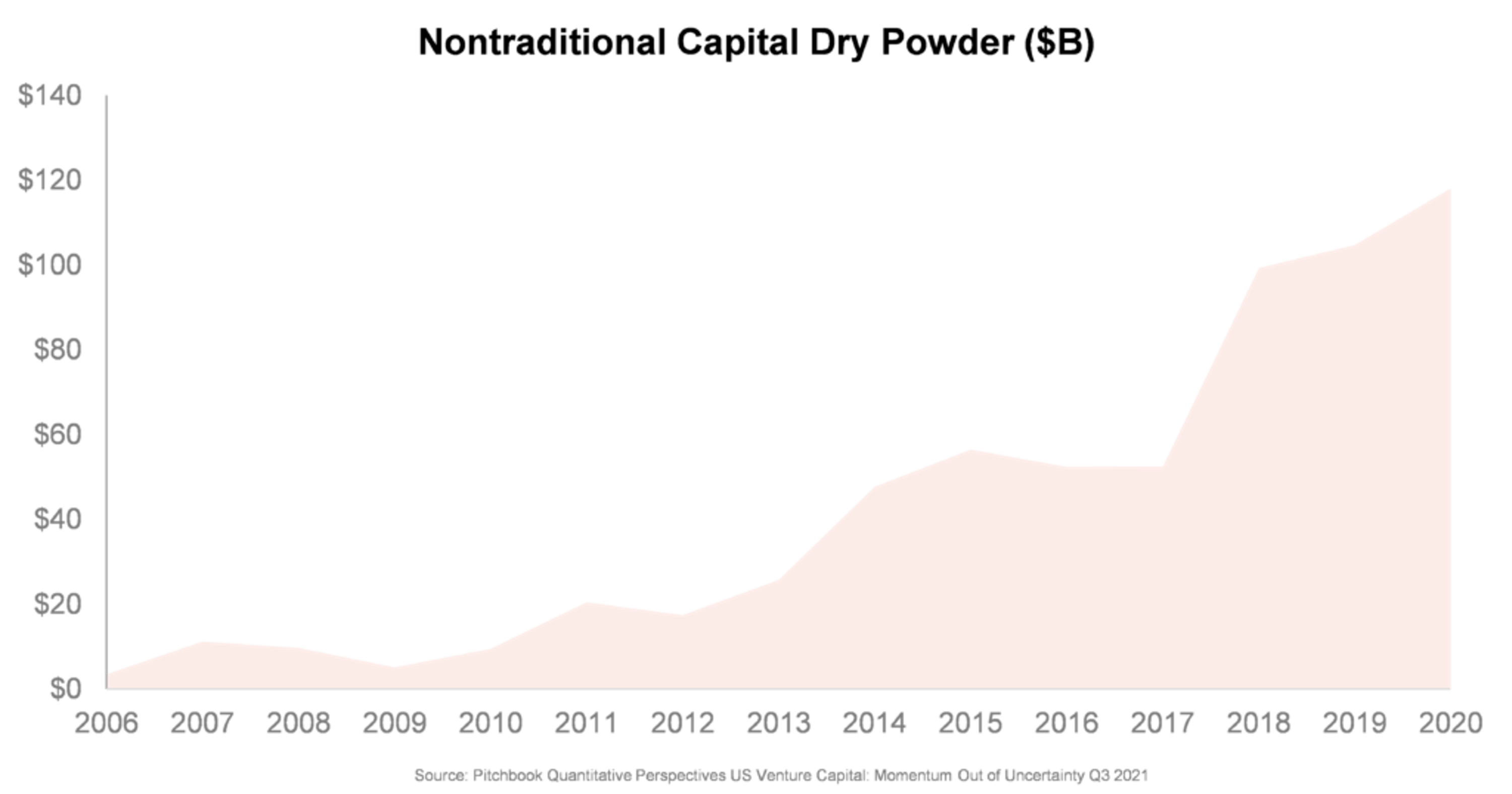

Additionally, there has been a rapid rise in nontraditional investors participating in or leading investment rounds. This category is comprised of hedge funds, mutual funds, corporate investors, and crossover investors. These investors have amassed a significant amount of capital dedicated to high-growth private market technology investments and there are no indications this trend will change anytime soon.

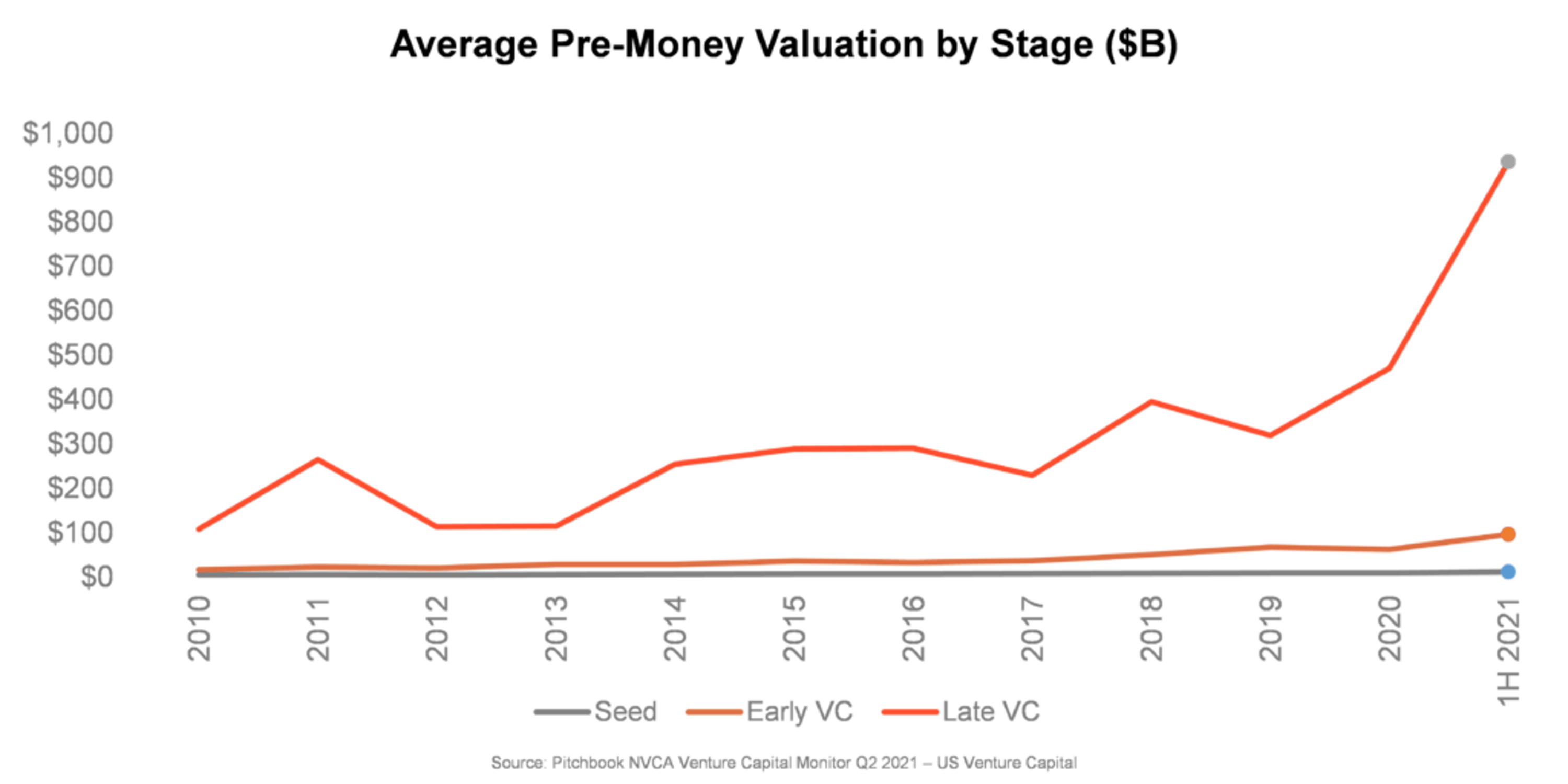

The abundance of capital has pushed late stage valuations higher in particular. Some investors do not appear to be price sensitive when it comes to investing in potential winners in large markets. In fact, some funds appear to be attempting to effectively create an index of late stage high-growth technology companies. Historically, venture capital index returns have been attractive because they include all of the outsized winners, those behind the industry’s well-known power law – very different from median or average returns for the industry, which are typically not as attractive. In a market where investors are searching for yields and are attracted to high-growth technology companies, late-stage indexing, which contributes to the high pace of deals, investment dollars and valuations, has become an acceptable strategy. Ironically, even as the 10-year Cambridge Associates Late and Expansion Stage Index has returned 17.1%, significantly outperforming most other asset classes, the Early Stage Index has done even better, returning 19.5% over the same period. Early stage investments clearly are where alpha can be generated in the venture capital market.

Exit Activity and Returns

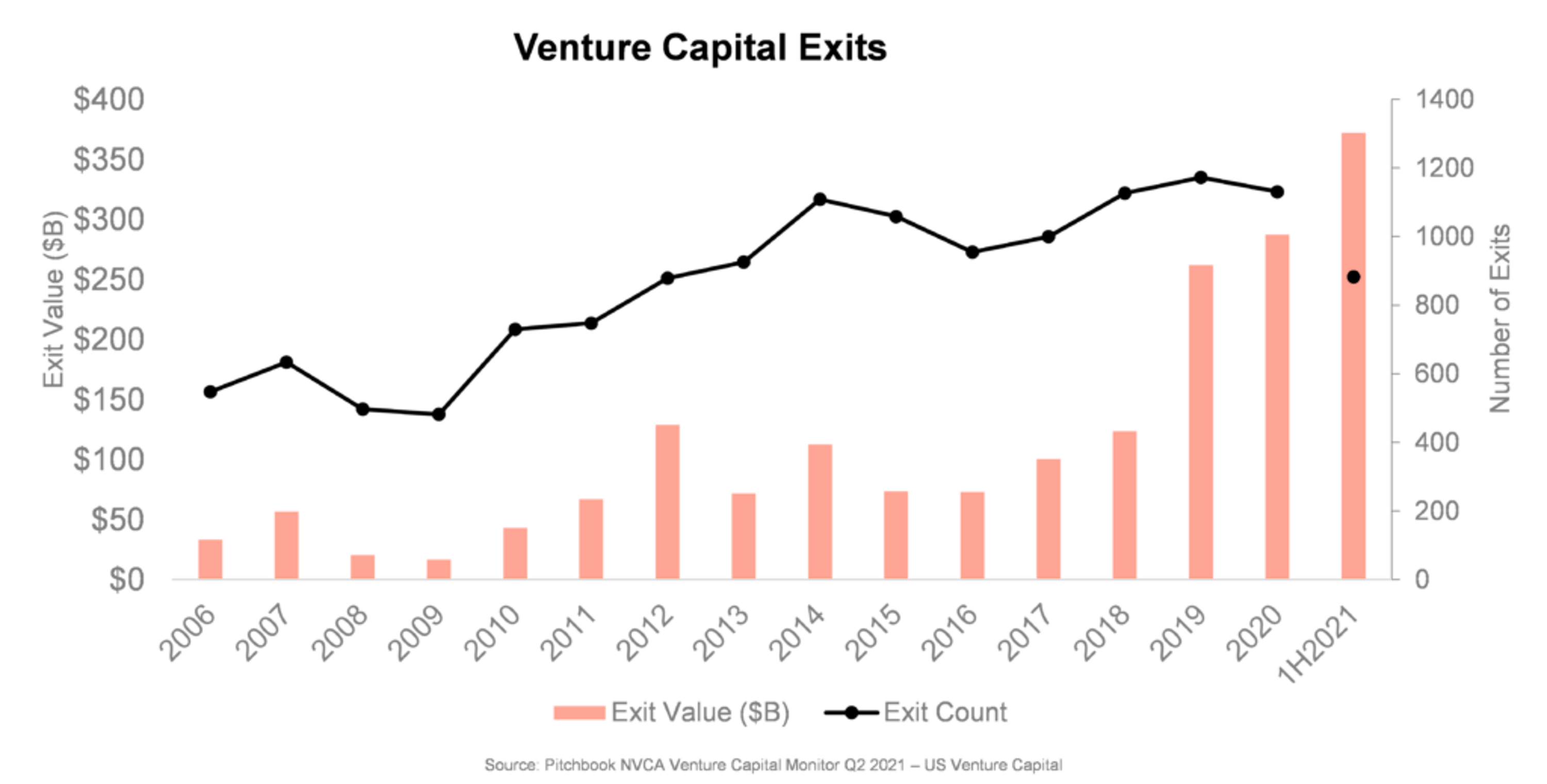

Amidst the increased fundraising and investment activity in venture capital, exit activity has also been robust. The IPO window has been open, aided by SPAC activity, while M&A activity has also been strong. Investors have benefited from record levels of liquidity at substantial return multiples over the past two years. Through mid-year, 2021 had already set a record for total venture-backed exit value. Venture capital exit windows are typically cyclical and hard to predict. While companies continue to stay private longer, perceptive investors are also taking advantage of opportunities to generate liquidity for limited partners through secondaries and other strategies, resulting in even more capital available for the asset class.

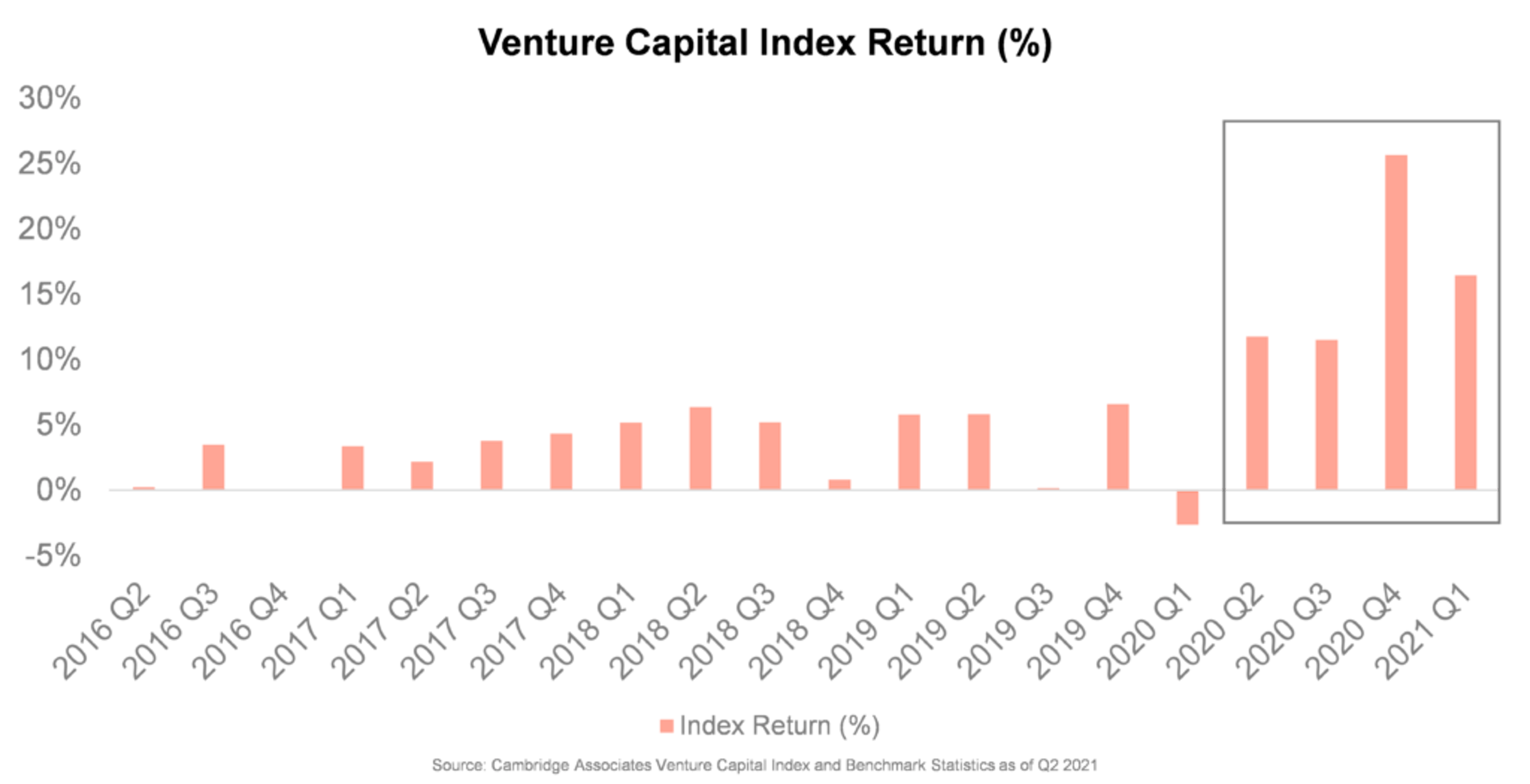

From a returns perspective, venture capital has experienced a major run since the second quarter of 2020. A strong exit market and heavy investor interest, generally funneling to the later stages of the market, has had a far-reaching impact, driving significant markups across the asset class.

The heightened late stage investment activity, which is relatively new, has driven valuations up across the board, and provided companies with significant runways. Intuitively, eventually the performance of these companies should reflect the distribution curve of venture capital returns, meaning not all of the companies receiving funding at high valuations in recent years will ultimately live up to the valuations reflected in the portfolios of venture capital firms. This in turn could result in a “correction” of returns down the road.

Sustainability of Current Trends

Given the market dynamics we have laid out, it is reasonable for limited partners to question the sustainability of recent trends and returns and approach the market with skepticism. Before addressing the potential challenges, it is worthwhile to examine the reasons why the recent trends may have the potential to endure. While impossible to predict, there are several indications that we are in the midst of a major technological and economic shift, with the global pandemic serving as an accelerant.

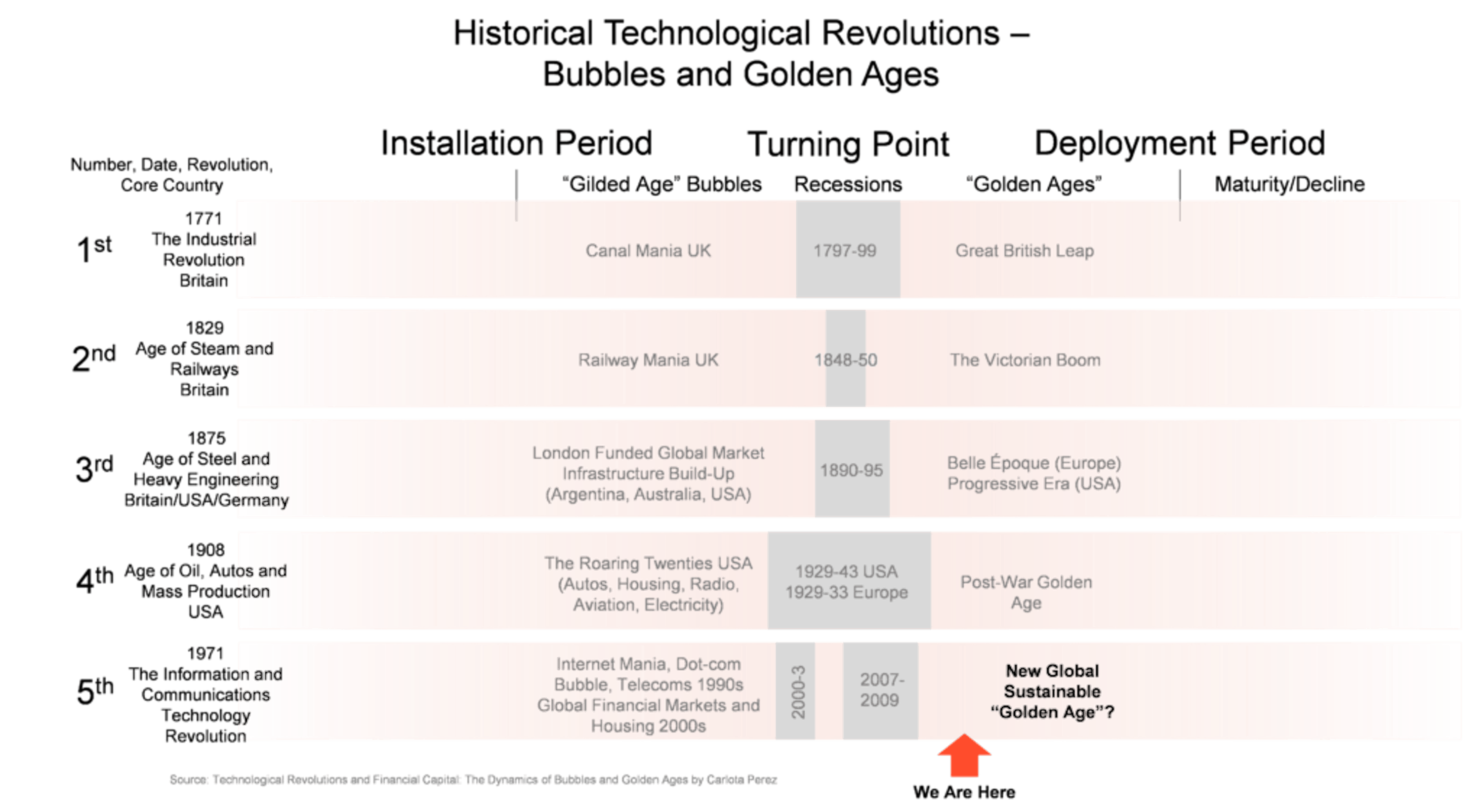

Now more than ever, the world is wide open for technology-driven change. The size of the markets, driven by internet and mobile phone penetration, are larger and more accessible than ever before. The technological infrastructure to serve these markets and build and quickly scale businesses is now in place, having been built over the last 20+ years. The financial markets naturally shift capital to where the growth is occurring. Historically, technological revolutions and financial capital have moved in cycles, as framed well by researcher Carlota Perez:

Additionally, investors often draw parallels to the dot-com bubble when technology markets seem frothy. However, the current market dynamics are quite different. Companies today are quickly and relatively cheaply able to build products and validate product-market fit, without the need for major investment in technology infrastructure. There are also more software and enterprise technology companies today – versus lower margin consumer companies – and these companies are more focused on revenue and achieving metrics required for sustainable growth (ARR, churn, etc.). Further, as indicated in the late stage valuation chart shared earlier, despite more capital at the later stages and some firms effectively seeking to index at the later stages, the market is still concentrating capital in the perceived winners of categories – potential breakout companies with strong metrics, not speculative concepts or businesses. The highest valued private companies today are proven businesses with major revenues in massive categories with high margins.

Causes for Concern

While there appears to be a strong case to be made for the sustainability of the trends in venture capital, the current market presents a host of challenges for new and experienced limited partners alike. The era of mega funds and new non-traditional pools of capital creates the possibility of significant market distortions that might portend future upheaval for the asset class. While many of these new entrants are well known and relatively accessible to limited partners, they are unproven at their current scale and geared more towards generating outperformance relative to the public markets.

Some more traditional venture capital firms have also quickly become large platforms, offering a range of funds delineated by stage, industry focus and geography. Limited partners are increasingly able to access these groups but are often required to invest across strategies. While the brands may be well known, they are unproven as larger platforms and limited partners may face performance dilution. One might argue that one way the venture capital landscape is changing is that there appears to be a bifurcation into aggregators and specialists.

As the market has grown, there has also been a rapid rise in new firm formation. Fairview has observed a substantial increase in new entrants raising first-time funds, with an estimated 500 such funds in market in 2021. While this development is positive for many reasons, including because these firms may be specialized, have higher return potential, and drive more ethnic, gender and cognitive diversity in the industry, it presents challenges for limited partners because of the sheer volume of funds. Not too long ago, focused and well-staffed limited partners could conceivably know most of the major players and review close to every institutional quality firm in the market. Given how important, market intelligence and manager section is in venture capital, and how dispersed returns are, it remains vital to see as much of the market as possible, but this has now become nearly impossible for the vast majority of limited partners.

In general, evaluating opportunities has become more difficult as so many firms possess seemingly strong track records on paper, particularly for funds formed over the past seven years or so. It may take years for the true performance of companies to be reflected in performance figures, particularly those currently held at significant markups that go on to become challenged. There are also now a generation of investors, at both tenured and new firms, who have not invested through a true market downturn or recession. The competition for deals and the expedited nature of some investments is also a potential challenge as some investors may rush due diligence processes or chase hot deals for the fear of missing them. The preferences of entrepreneurs and what they look for in a venture capital firm has been changing as well, challenging the ability of some firms to win deals based on speed and valuation primarily, and requiring shifts in approach.

Considerations for Navigating the Market

Fairview often reminds limited partners that venture capital is a long-term asset class. While it can be easy to get caught up in the headlines and short-term trends, in practice, venture capital investing requires a patient, steady, long-term approach. We have always believed that innovation, the lifeblood of venture capital, will progress unrelentingly and independent of economic cycles, and that investing with the most talented, motivated, forward-thinking individuals leveraging innovation to build the companies of the future will be financially rewarding. We believe it is well worth the effort to seek out the managers best positioned to access the most transformational companies effectively – those that have remained focused, are truly differentiated, disciplined and experienced. In a quest to do that, some dynamics we think investors need to look for, or pay more attention to, include the following:

- Ability to attract top entrepreneurs:

The best firms of today are able to attract or convince top entrepreneurs to work with them. They offer tangible value-add and have great founder references and portfolios that confirm their reputations. We find that many top entrepreneurs will work with firms at lower valuations, understanding the value of the right partners at the right stage. Firms that recognize and convey the dynamics of startup fundraising can greatly benefit in the current market. We believe limited partners should prioritize such firms. Additionally, with founders now coming from a broader range of backgrounds, firms that can proactively build new networks will benefit.

- Specialization and thematic approaches:

As competition for accessing the best entrepreneurs has increased, the benefit of specialization has also increased. Deeply thematic approaches implemented by managers who are genuinely embedded in the markets in which an entrepreneur is building a company can be a major advantage. Sector-focused firms as well as generalist firms taking thematic approaches with partners dedicated to specific sectors can achieve the benefits of specialization.

- Adaptation to the valuation environment:

How firms have adapted to the valuation environment could have implications for strategy and returns. For example, given the valuation environment, while some firms have tried to find ways to compete for deals at their target stages, others have shifted to investing earlier. Meanwhile, as some firms have gotten larger, they have shifted to investing later, making more financial type investments versus investing in risk to fuel innovative businesses for growth – the approach that likely brought the firm its initial success. Limited partners should be aware of how these shifts align with expectations and the impact they could have on the risk-return profile of a portfolio.

- Changes to investment decision-making processes:

Many general partners have been forced to alter their approach to due diligence. Investment rounds for many sought-after companies have become highly competitive and feature expedited processes. Speed has become a factor in winning deals, which means firms must make faster decisions to remain competitive. Limited partners should be comfortable with how firms conduct diligence on companies in compressed timeframes. Ideally, expedited deals have undergone “pre-diligence” and firms have already spent time getting to know the company and market.

- Substantiated performance:

Investing in this market requires extra work on the part of limited partners to validate performance. In some cases, capital at later stages is not being deployed efficiently, resulting in valuations inconsistent with the performance of a company or its performance relative to competitors. This may contribute to write-ups in the portfolios of early stage funds that might not be justified. Limited partners need to understand startup metrics, and evaluate factors such as portfolio company culture, market and other KPIs. Assessing the quality of syndicate partners and prior investors is also becoming increasingly important.

- Alignment of interest:

As firms increase the amount of capital under management, limited partners must assess alignment of interest as this can shift when incentives are impacted as much (or more) by fund size as by performance. It is important to understand the motivation behind raising more capital, including the long-term strategy objectives of the firm.

As the characteristics that limited partners need to look for change, their approach to building venture capital exposure may need to change too, including:

- Becoming more comfortable with relationship turnover and investing with younger firms:

While performance persistence remains a dynamic unique in many ways to venture capital, many firms are testing the effect by scaling and shifting strategies relatively rapidly. There is no doubt that some firms will continue to exhibit the persistence effect, but limited partners should be comfortable moving on from firms that are no longer optimally oriented. As some firms have scaled up, many younger firms, often led by experienced investors, have come in to fill the void.

- Dedicate more resources to sourcing and due diligence:

As covered, finding the best opportunities in venture capital has become more challenging. Limited partners must find ways to cover the expanding pool of managers in order to identify the best firms. Due diligence now requires more effort and time given the market dynamics.

- Become more embedded in the ecosystem:

Given how rapidly the market has shifted, and may continue to shift, it is more critical than ever to be deeply embedded in the market. Better and faster access to information can a make major difference. Investors with an advantage in market intelligence will be significantly better positioned to succeed.

- Leverage the appropriate resources and partners:

Investing in the right people and partners to navigate the venture capital ecosystem can drastically improve the potential of a portfolio, particularly for limited partners without dedicated venture capital investment professionals or access to the requisite market intelligence and firms. As venture capital grows and becomes more complex, the value of the right partners can have a significant impact on performance and the strategic building of a successful venture capital program.

As the market has grown and changed, finding the optimal risk exposure and risk-adjusted returns in venture capital has become challenging. We believe that a portfolio geared towards early stage investing, with a selective approach to late stage and growth, will provide the best long-term returns. Done right, early stage investing has always had the potential to generate significant outperformance, and in the current market environment, early stage investments face relatively less competition and have featured less valuation growth. However, we continue to believe a portfolio approach is critical. Building an appropriately diversified portfolio of best in class firms, in turn investing in the best companies, and selectively co-investing, is a time-tested approach.

At Fairview, we continue to believe that engaging in the market with a prepared mind and backing the firms that will back the leading entrepreneurs innovating in new and large markets will continue to be highly attractive. While this new era of venture capital may present challenges for limited partners, we believe the additional work and changes it will take to identify and access the best opportunities will be well worth the effort, as it has always been.